Unleash the Power of Viral Culture

Experience the thrill of the internet’s most viral content all in one place. From heartwarming tales to jaw-dropping feats, explore the latest buzzworthy moments that everyone is talking about.

Read more

Featured post

Photo by Joshua Rawson-Harris on Unsplash

Photo by Joshua Rawson-Harris on Unsplash Featured post

Exploring the Viral Culture: Unveiling the Best of the Internet

March 12, 2024 | by bubonik.com

Latest posts

View all

Photo by ASWIN CHANDRAN on Unsplash

Photo by ASWIN CHANDRAN on Unsplash  Photo by ASWIN CHANDRAN on Unsplash

Photo by ASWIN CHANDRAN on Unsplash Exploring the Viral World of the Internet: Curated Content and Captivating Stories

March 12, 2024 | by bubonik.com

Photo by Joshua Rawson-Harris on Unsplash

Photo by Joshua Rawson-Harris on Unsplash Exploring the Viral Culture: Unveiling the Best of the Internet

March 12, 2024 | by bubonik.com

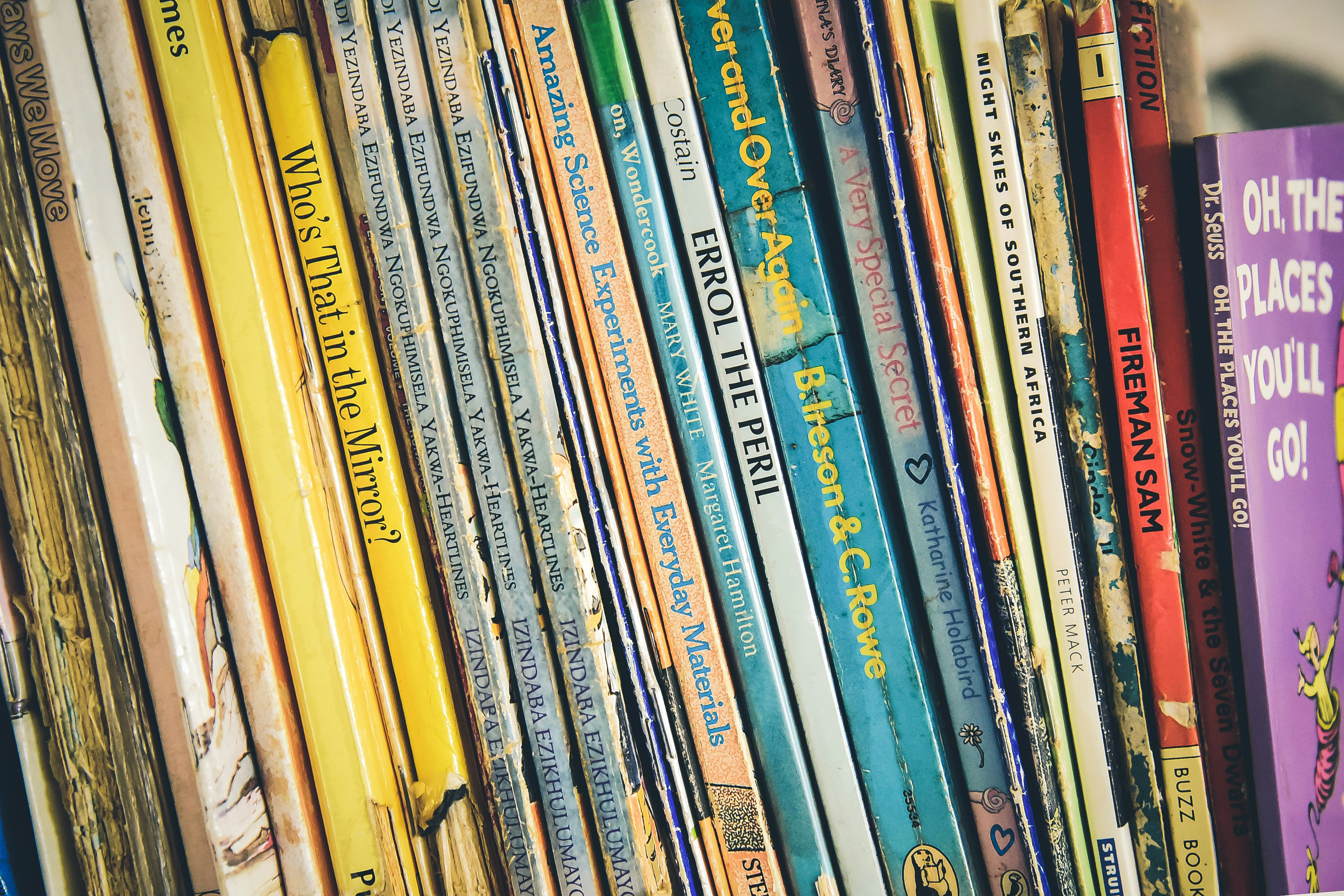

Photo by Robyn Budlender on Unsplash

Photo by Robyn Budlender on Unsplash  Photo by Unseen Studio on Unsplash

Photo by Unseen Studio on Unsplash Exploring the World of Viral Content: Unveiling the Magic of Internet Trends

March 12, 2024 | by bubonik.com

Photo by Glenn Carstens-Peters on Unsplash

Photo by Glenn Carstens-Peters on Unsplash